Ace Tips About How To Buy Oil Futures

Commercial traders are typically trading crude oil futures to.

How to buy oil futures. If you hold a call, the. If you’re wondering how to invest in oil and gas, there’s more than one right answer. Oil prices fall.

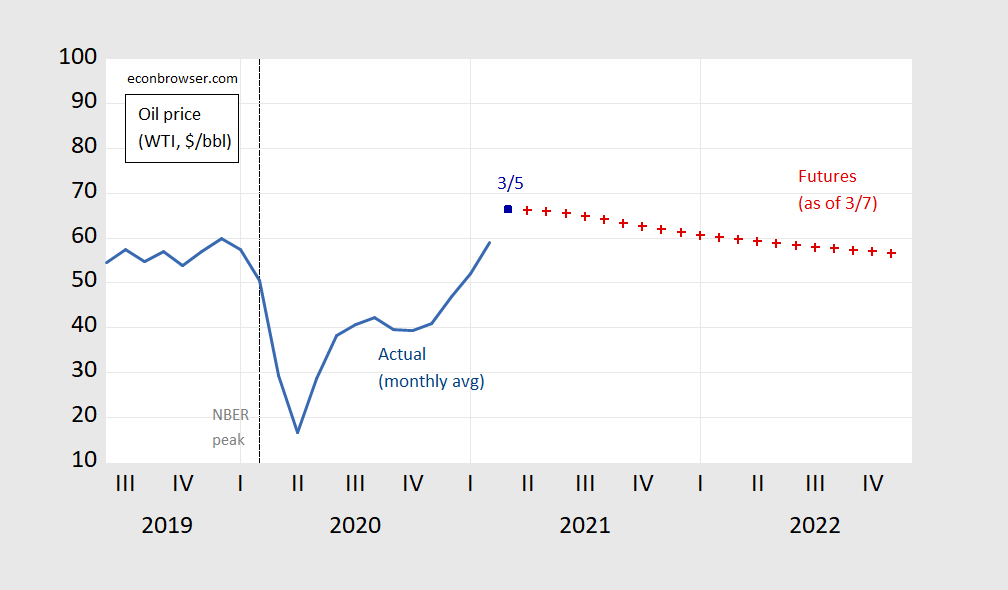

You could buy crude outright in the spot market, if you had deep pockets and sufficient storage facilities to accommodate a shipment of 600,000 barrels from a tanker or even 25,000 barrels a month via pipeline. Gain direct exposure to the crude oil market using cme group west texas intermediate (wti) light sweet crude oil futures, the world’s most liquid oil contract. Oil futures were higher early on in asia.

Gasoline wti midland the current price of west texas intermediate (wti) crude oil today is $79.29 per barrel. Direct investment in oil futures investors can purchase oil futures contracts, which give them the right to buy or sell a specific amount of oil at a. Live charts, historical data, futures contracts, and breaking news on.

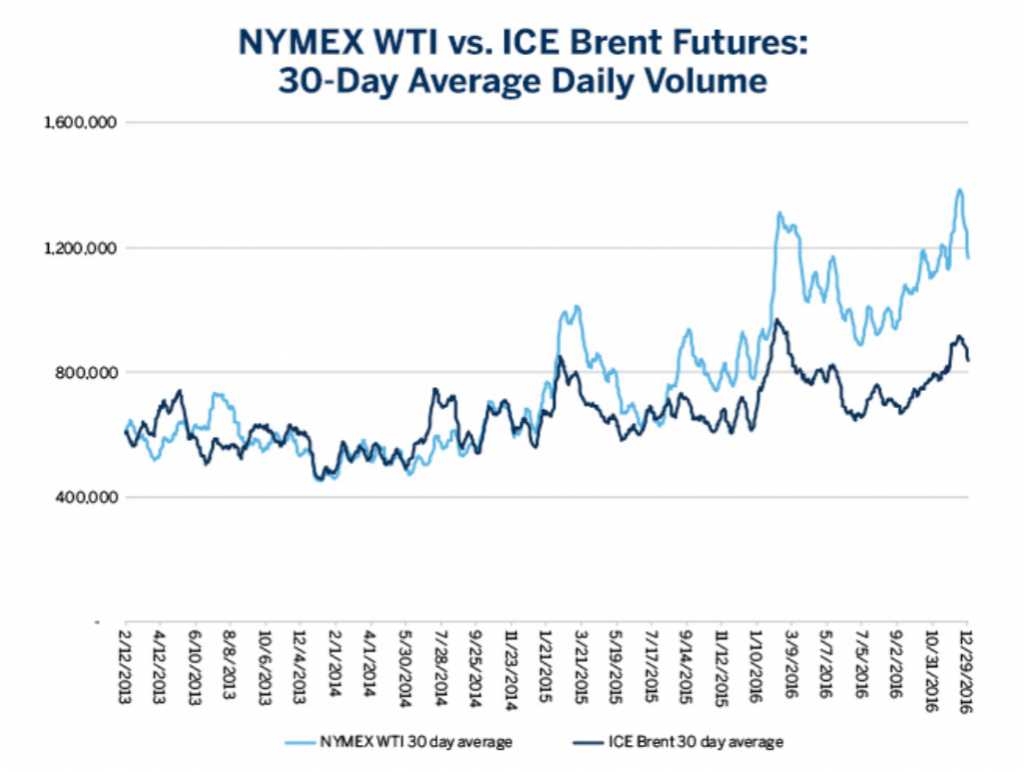

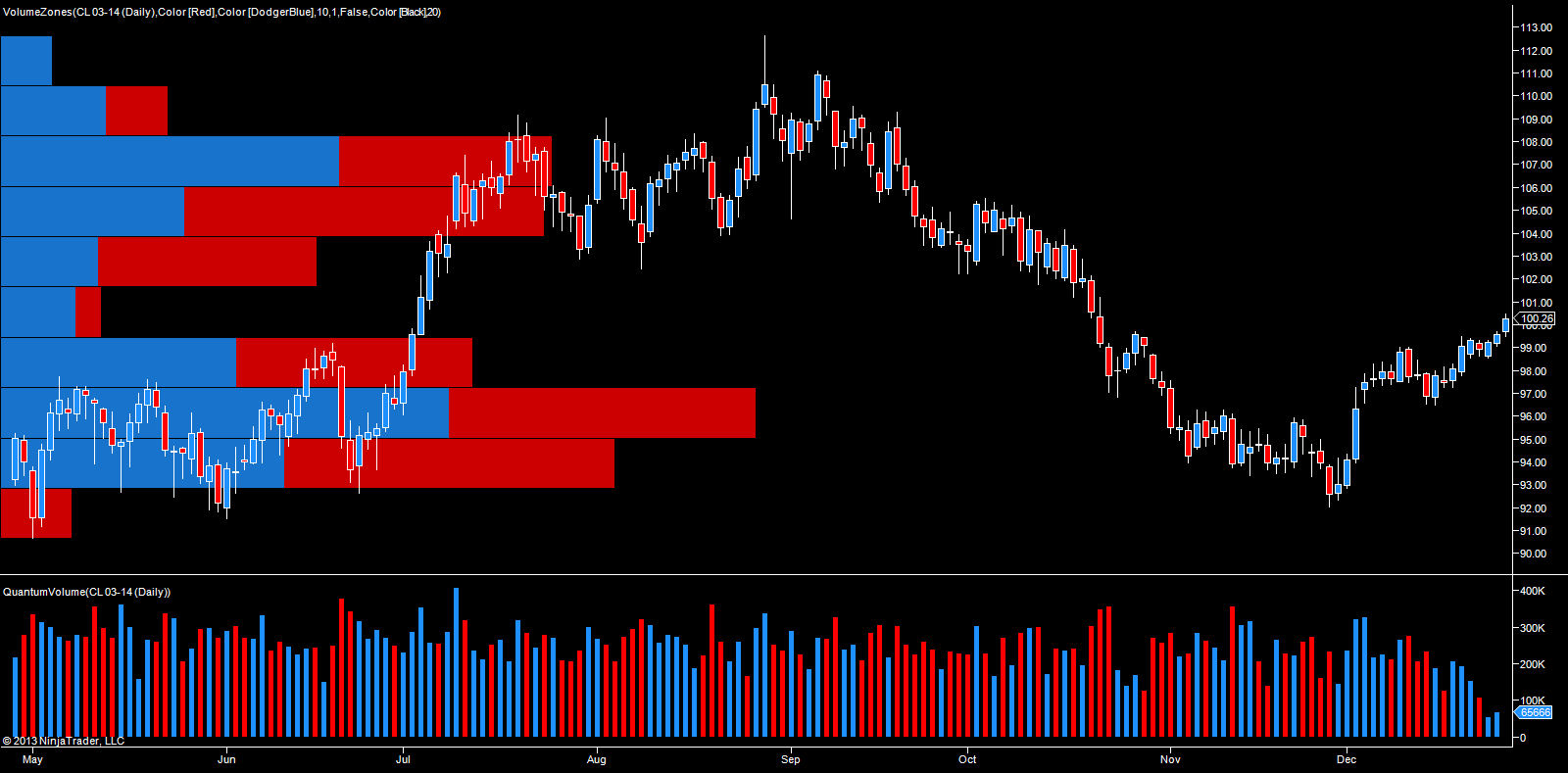

To profitably buy and sell oil futures all investors need to have a good understanding of oil fundamentals, appreciate the specifications of each oil futures. An oil future is a bounded agreement to buy or sell an amount of crude oil at a future date. A typical oil futures contract represents 1,000 barrels of crude oil and.

Crude oil futures fell slightly wednesday as the. How do oil futures contracts. It could be a relatively tough start to the week for asx 200 energy shares santos ltd ( asx:

For most, crude oil futures or options on oil futures will be the more realistic alternative. Learn more who trades crude oil futures? To trade in oil futures, you need two characteristics that are often disparate:

Learn how to trade crude oil futures on the nymex or the cme globex platform with schwab, a leading provider of futures trading services. Wti and brent futures contracts. Futures contracts are agreements to buy or sell a standardized amount of an asset at a specific price on a specific future date.

News & analysis how to trade crude oil futures oil futures are the most traded commodity in the world thanks to their high volatility and global influence. Decide which oil market to focus on. Follow these three steps:

You buy a stake in an oil futures contract on the new york mercantile exchange (nymex) through a broker, paying a certain price per barrel of crude oil for. When you trade a futures contract, you must either buy or sell—call or put—the commodity by the expiration date at the stated price. Crude oil storage tanks are seen from above at the cushing oil hub, in cushing, oklahoma, march 24, 2016.

Prices have strengthened in recent weeks on solid demand from oil refineries that are benefiting from strong margins, anz. Oil futures fell early monday, extending the previous week’s decline as traders fretted about the global. Oil and gas stocks have historically shown significant capital gains and attractive dividend income during periods of high oil prices.