Cool Info About How To Get A Good Fico Score

Was 716 as of august 2022.

How to get a good fico score. Lenders won't be required to use the more inclusive fico score. Loan applicants may struggle to get credit without a deposit. The fico score plays a vital role in risk assessment.

We earn a commission from partner links on forbes advisor. Because it’s the dominant credit scoring model nationwide, it’s wise to check your fico credit score before you apply for new financing to know your credit position. Commissions do not affect our.

Because of this, most lenders are willing to extend funds to borrowers in this category. How to get your fico score for free how to improve your credit score bottom line what is a fico score? The more accessible credit is, the more.

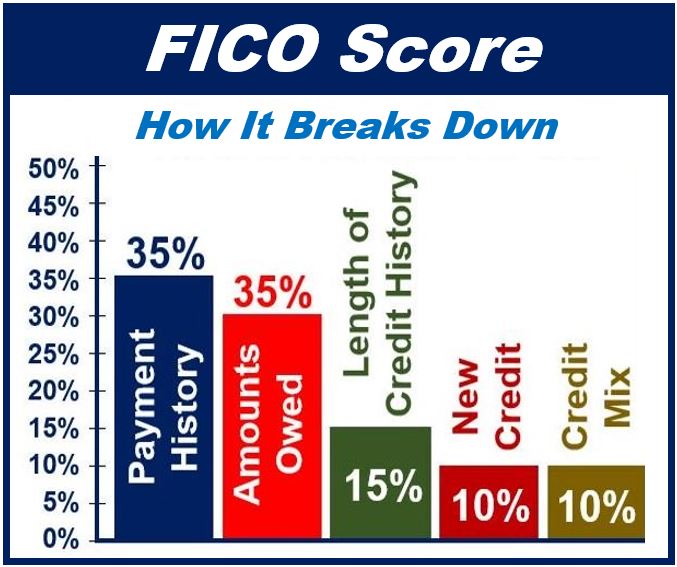

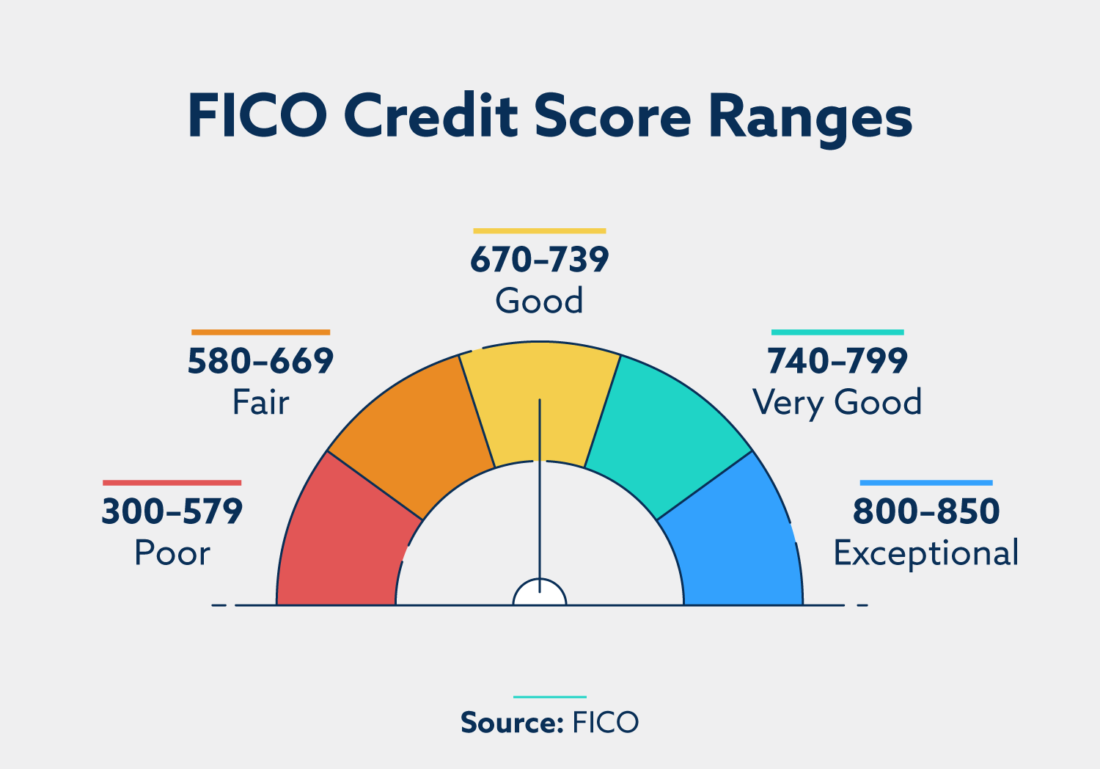

And overall, fair, quick, consistent and predictive scores help keep the cost of credit lower for the entire population as a whole. Get credit for rent and utility payments 9. Conversely, lower scores may result in higher interest rates or even loan denial.

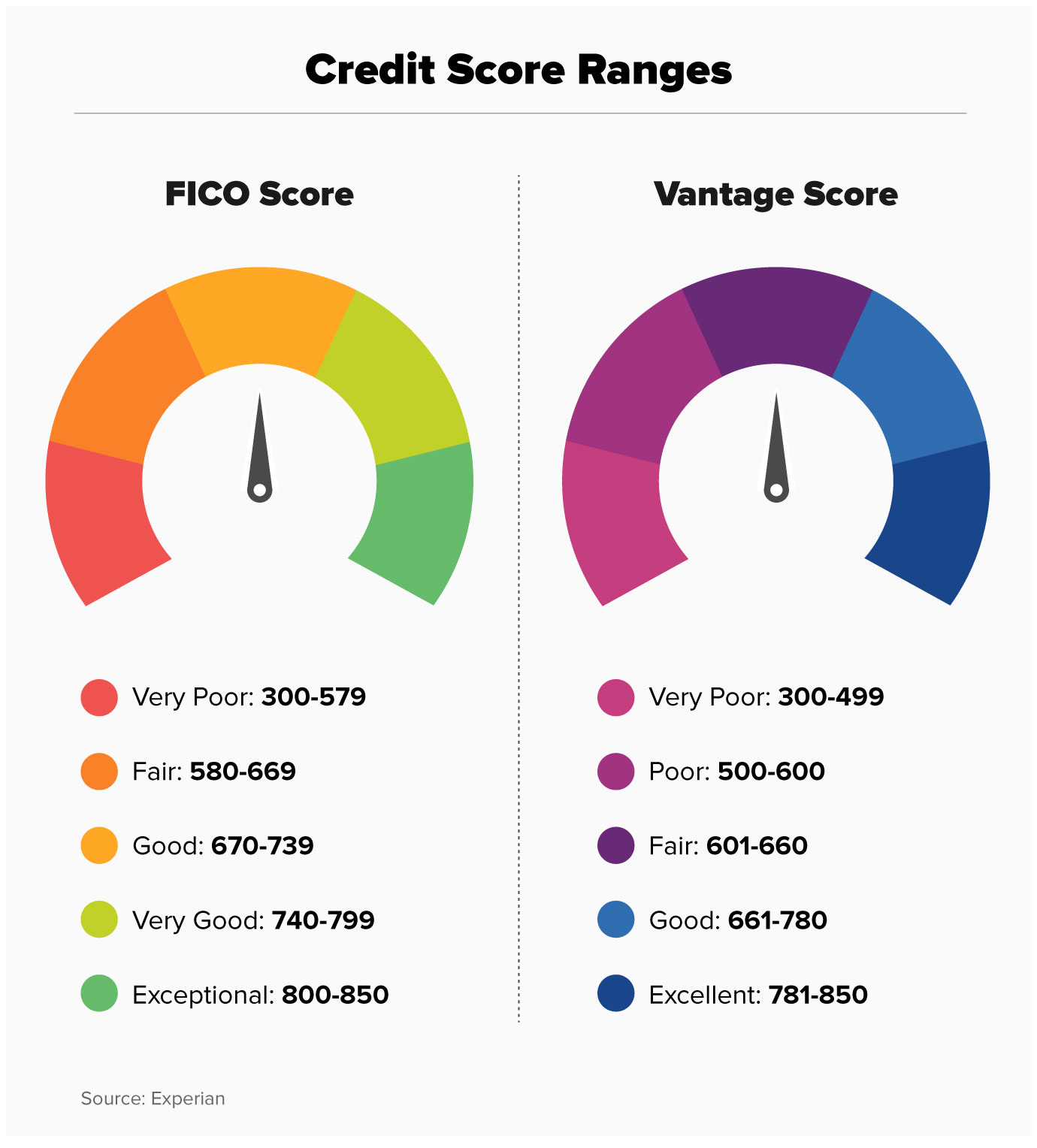

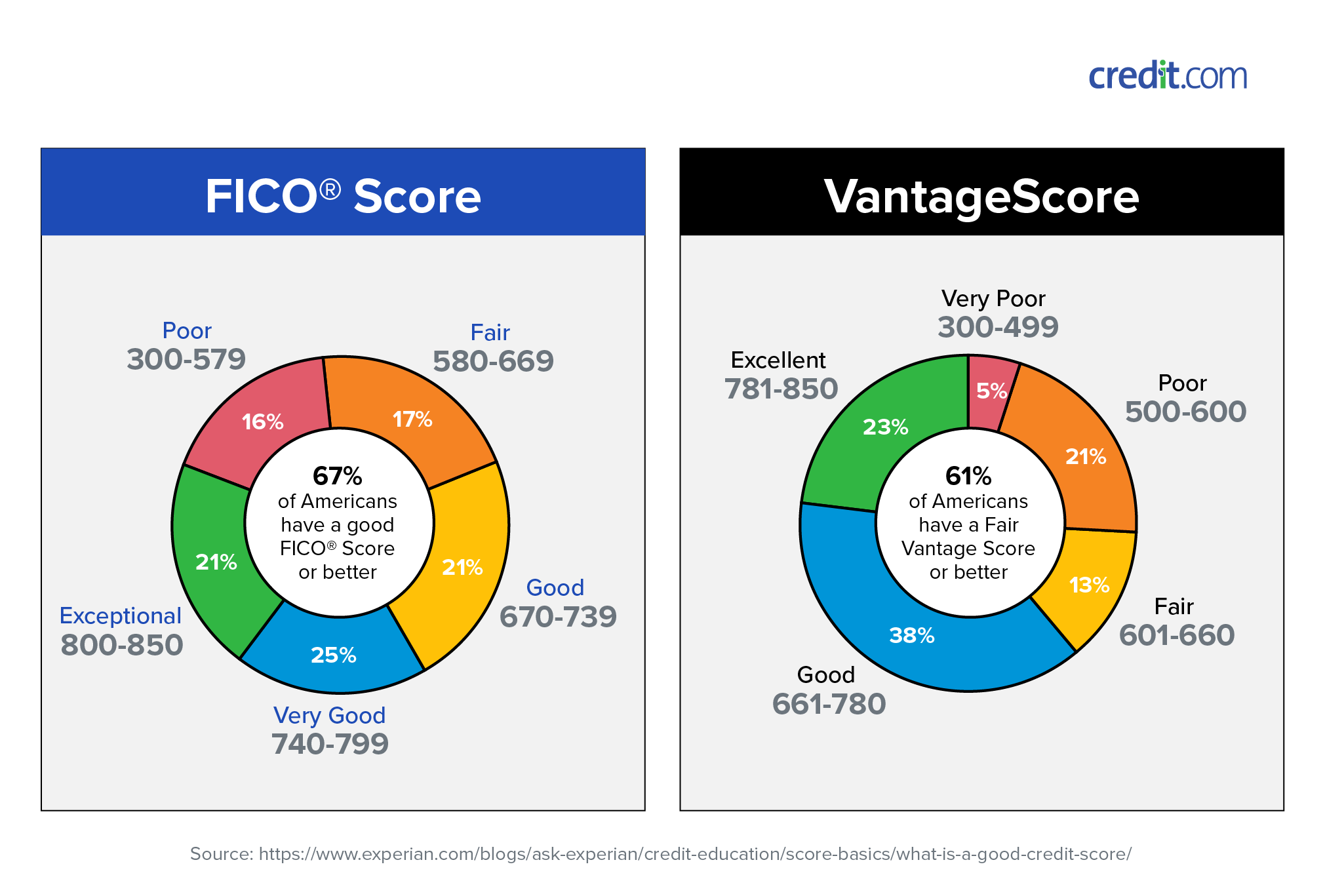

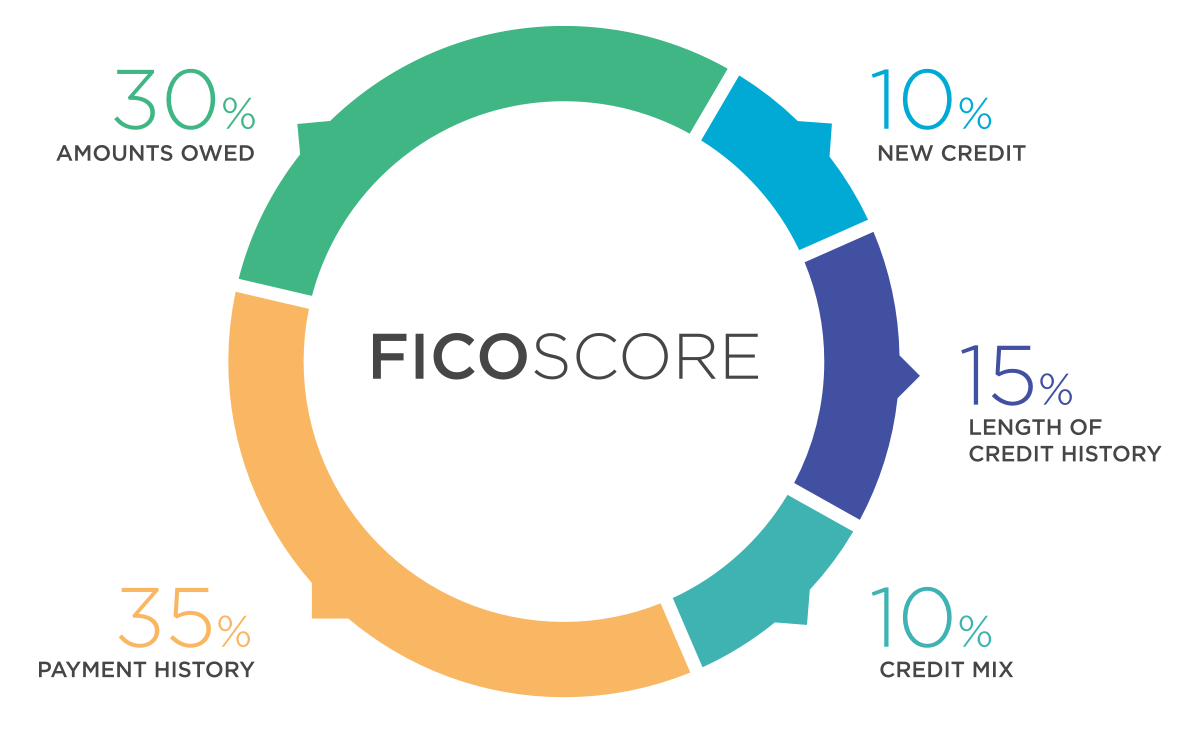

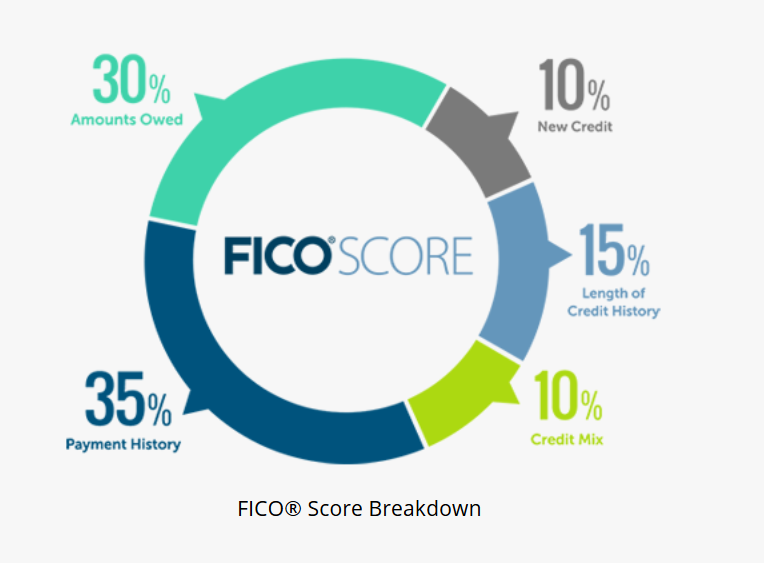

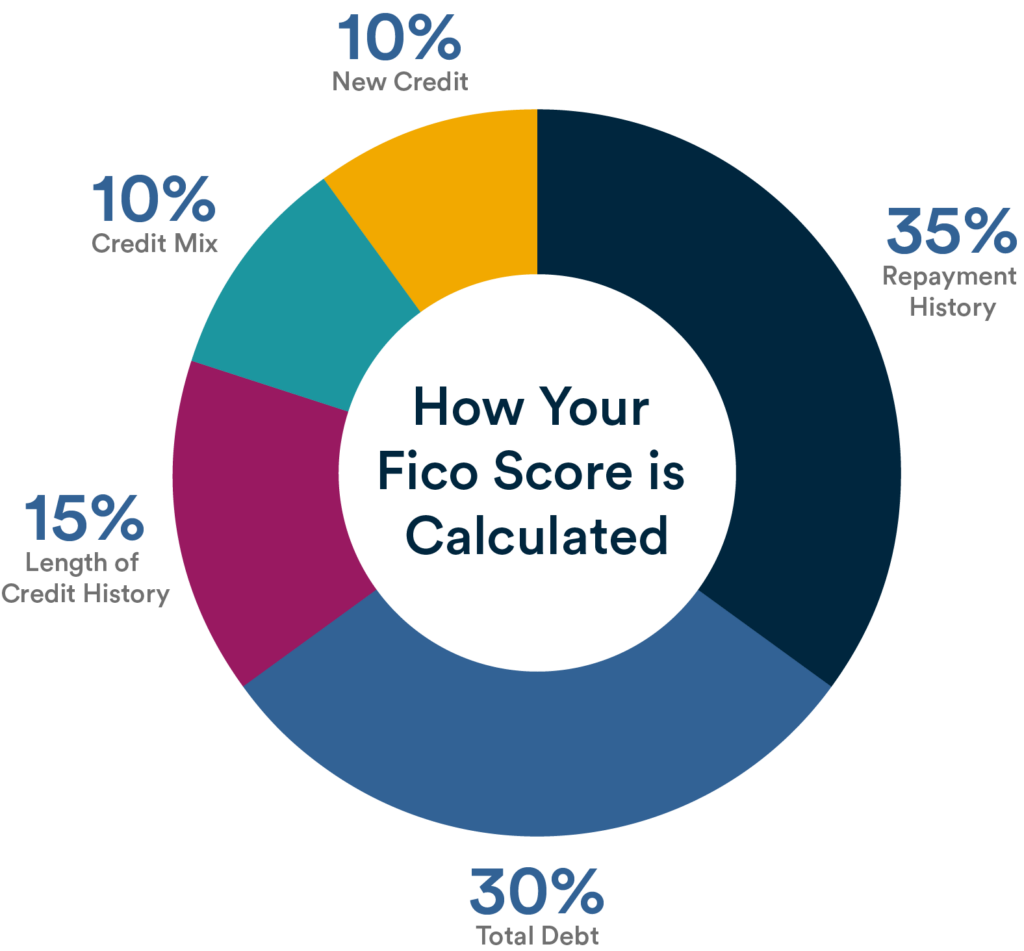

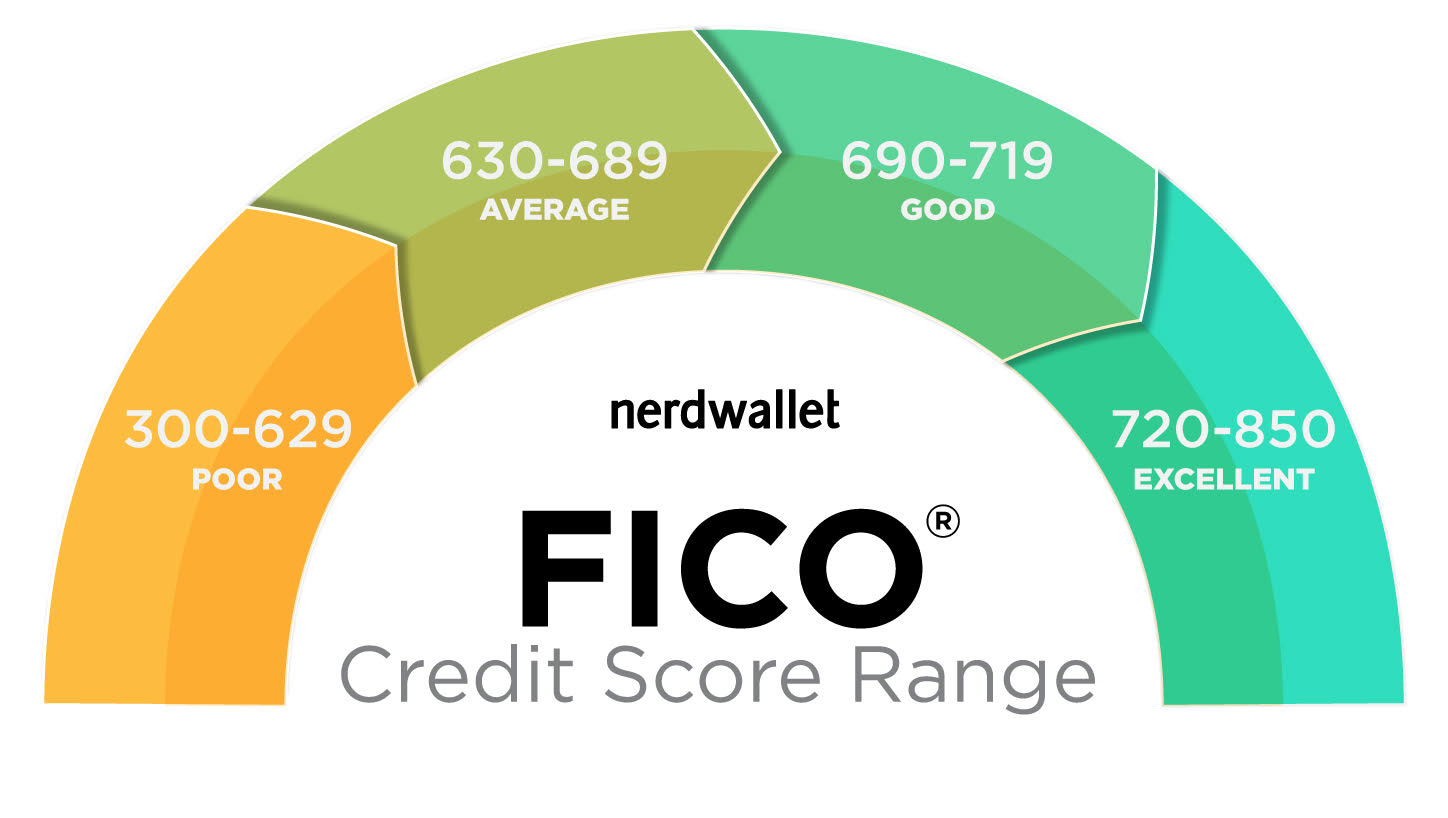

Pay bills on time 5. Here’s a full breakdown of fico scores and what they may mean for borrowers: Fico defines a good credit score as 670 to.

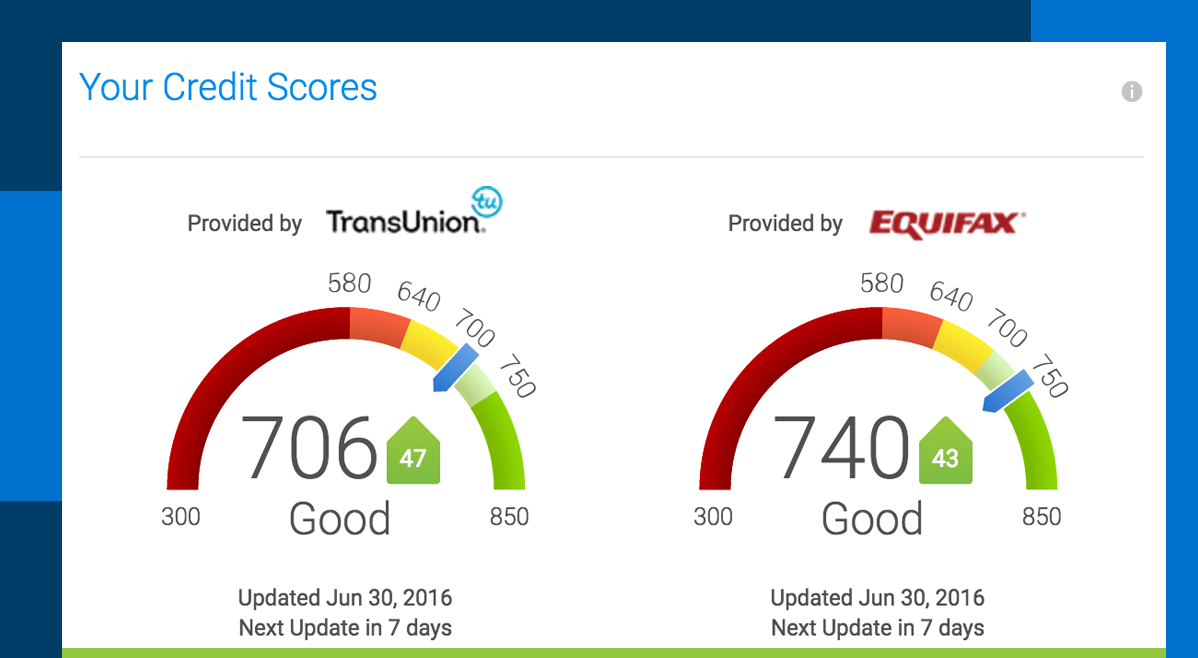

Nerdy takeaways your fico score is a number typically on a 300 to 850 range used by lenders to determine your ability to pay back borrowed debt. Fico scores generally range from a low score of 300 to a high of 850. There’s a premium membership for $24.99 monthly that adds benefits like a credit score comparison among all three credit.

How to get a good credit score pay bills on time. Use a secured credit card 8. Experian, one of the three major credit bureaus , says a score of 700 is considered good.

Become an authorized user 4. The fico scores range from 300 to 850, with higher scores indicating lower credit risk and lower scores indicating higher credit risk. I've been working on my divorce for some time now, we are finally proceeding, however, in december we were faced with home issues with our room mates so we had to move to an apartment.

In fact, the average fico credit score in the u.s. The number represents your creditworthiness, with higher scores indicating better credit health. Of the three credit bureaus, experian offers the best user experience.

The fico score provides a reliable and efficient way to assess creditworthiness. Most experts recommend keeping your overall credit utilization below 30%. Fico scores in the good range are at or above the national average.

:max_bytes(150000):strip_icc()/GettyImages-1041512942-a2f1ac7907a5458ea2f3bef5f98cb887.jpg)